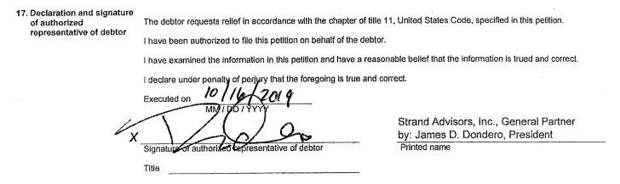

In the latest bizarre development to hit the flailing world of hedge funds, this morning Bloomberg first reported that one of the largest and well-known hedge funds, James Dondero's Highland Capital Management had filed for bankruptcy. Dondero's signature on the Chapter 11 filing which hit Delaware Bankruptcy Court this morning, docket 19-12239, is shown below.

The unexpected bankruptcy filing stems from potential judgment against the entity that would exceed its liquid assets, Bloomberg reported citing a statement sent by the firm. No other Highland entities are filing and business operations will continue without interruption, according to Highland.

In a statement emailed to Bloomberg, Highland said that "the potential judgment against HCMLP relates to a crisis-era fund previously managed by HCMLP. The fund has been in liquidation since 2011. Rather than liquidating the fund at the height of the crisis for pennies on the dollar, HCMLP carried out a liquidation process over time intended to maximize recoveries for investors."

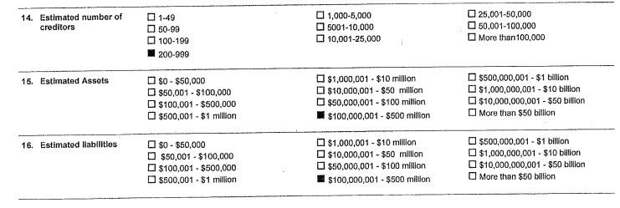

To be sure, the AUM appears to have declined significantly in recent years, and the firm listed between $100 and $500 million in assets and liabilities in its petition filed in Delaware.

Highland listed Redeemer Committee of the Highland Crusader Fund as its largest unsecured creditor with a $190 million disputed claim.

Highland, which was founded in 1993 and manages assets in stocks, distressed and high yield debt, as well as real estate and structure products, was best on Wall Street as a credit-market pioneer, and structured one of the first collateralized loan obligations. The firm launched its first bank-loan fund for institutional investors in 2000 and entered the mutual fund space in 2004. As Bloomberg adds, "in 2010, it bought a number of funds from GE Asset Management, and in 2012 it launched its first loan exchange-traded fund." Headquartered in Dallas, Highland maintains offices in Buenos Aires, Rio de Janeiro, Singapore, and Seoul.

On its website, Highland describes itself as operating "a diverse investment platform, serving both institutional and retail investors worldwide. In addition to high-yield credit, Highland’s investment capabilities include public equities, real estate, private equity and special situations, structured credit, and sector- and region-specific verticals built around specialized teams."

While Highland hopes to continue operating throughout the bankruptcy process, at least one of its founders has decided to call it a day: fund co-founder, Mark Okada is retiring from the asset manager, the firm said in September. Okada, 57, has an advisory role through the end of the year and retain his ownership stake, according to a statement.

While the fund's primary investment scope is debt, its latest 13F showed $1.7 billion in US stocks held by the fund as of June 30. The top holdings per its latest 13F are shown below.

The full bankruptcy filing is below: